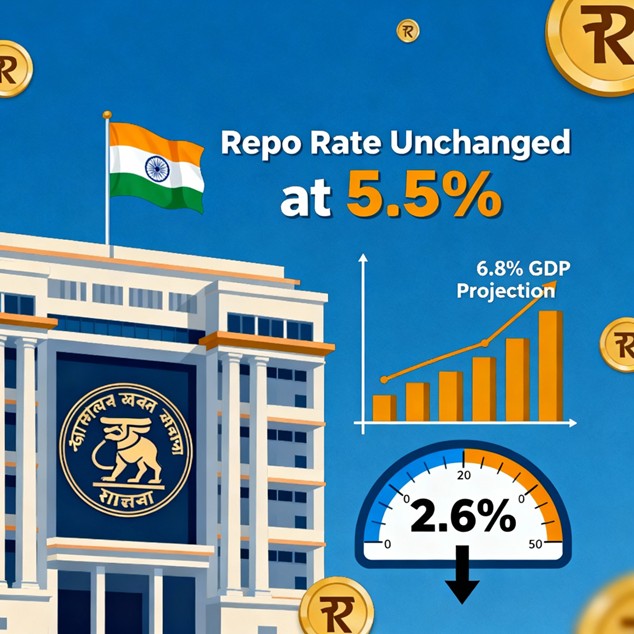

The Reserve Bank of India made a crucial decision today. RBI Governor Sanjay Malhotra kept the repo rates unchanged at 5.5%. However, the central bank surprised markets by raising GDP growth forecasts. This move comes amid global trade tensions and domestic policy changes.

RBI October 2025 monetary policy decision maintaining repo rate with economic projections

What RBI Decided about repo rates?

The Monetary Policy Committee voted unanimously. All six members agreed to keep rates steady. Moreover, they maintained the neutral stance from August.

Key Rates Decisions

- Repo Rate: Unchanged at 5.5%

- Reverse Repo Rate: Remains at 5.25%

- Bank Rate: Stays at 5.75%

- CRR: Continues at 4%

This marks the second consecutive meeting without rate cuts. Previously, RBI had cut rates by 100 basis points this year.

Positive Economic Projections after repo rates

Despite keeping rates steady, RBI delivered good news on growth. Furthermore, inflation forecasts turned even more favorable.

GDP Growth Upgraded

FY26 Growth Revised Higher:

- New Forecast: 6.8% (up from 6.5%)

- Q2 FY26: 7.0% (raised from 6.7%)

- Q3 FY26: 6.4% (cut from 6.6%)

- Q4 FY26: 6.2% (cut from 6.3%)

Additionally, the first quarter already showed strong 7.8% growth. This exceeded all expectations.

Repo Rates Improves Inflation Outlook

CPI Inflation Cut Significantly:

• FY26 Forecast: 2.6% (down from 3.1%)

• Q2 & Q3: Just 1.8% each

• Q4: 4.0%

• Q1 FY27: 4.5%

Consequently, inflation remains well below the 4% target. This gives RBI more room for future policy support.

Why RBI Held Rates Steady

Governor Malhotra explained the reasoning clearly. Several factors influenced this cautious approach.

Policy Impact Assessment

“We need time to assess policy changes,” said Malhotra. The central bank wants to see effects of:

• Earlier 100 bps rate cuts

• Recent GST rationalization

• Fiscal policy measures

Global Trade Uncertainties

Trade tensions create policy challenges. Specifically:

• US tariffs on Indian exports (up to 50%)

• H-1B visa fee increases

• Global supply chain disruptions

These factors could impact India’s export growth significantly

Balanced Risk Management

The MPC noted both opportunities and risks. On one hand, low inflation supports growth. On the other hand, external headwinds require caution.

Impact on Different Sectors

RBI’s decision creates mixed reactions across sectors. Let’s examine the specific effects.

Positive Impacts

Banking Sector Benefits:

• Net interest margins remain stable

• No pressure on deposit rates

• Lending rates stay competitive

Real Estate Sector:

• EMI rates remain predictable

• Festive season buying continues

• Developer confidence stays strong

Manufacturing:

• Capacity utilization at 75%

• GST cuts boost demand

• Investment climate remains supportive

Negative Impacts

Export Sector Challenges:

• US tariffs hurt competitiveness

• Currency volatility affects margins

• Trade negotiations remain uncertain

Interest-Sensitive Sectors:

• Auto sector faces headwinds

• Consumer durables see slower growth

• Housing demand could moderate

People’s Sentiment and Market Reactions

Markets showed mixed reactions to RBI’s decision. However, overall sentiment remained positive.

Stock Market Response

Initial Market Reaction:

• Sensex up 0.36% during announcement

• Nifty gained 0.30%

• Banking stocks performed well

Sector Performance:

• Real estate stocks rallied

• Export-oriented sectors declined

• FMCG stocks remained steady

Expert Opinions

Positive Views:

“RBI’s prudent approach balances growth and stability,” said Dr. Manoranjan Sharma from Infomerics Ratings.

Cautious Views:

Some economists wanted rate cuts. They argued low inflation justified easier policy.

Consumer Sentiment

Home Buyers:

• EMI certainty during festive season

• Stable borrowing costs

• GST benefits on construction

Savers:

• Deposit rates remain attractive

• Fixed income stability

• Reduced volatility

Global Importance of RBI’s Decision

India’s monetary policy impacts global markets significantly. Several international factors matter.

Emerging Market Leadership

India remains a growth leader among major economies. Therefore:

• Foreign investment flows continue

• Currency stability improves confidence

• Regional monetary policies get influenced

Trade Balance Effects

Export Competitiveness:

• Stable rates help maintain cost advantage

• However, US tariffs create challenges

• Rupee depreciation offsets some impact

Import Dynamics:

• Lower inflation reduces import pressure

• Energy costs remain manageable

• Capital goods imports for growth

Global Inflation Trends

India’s low inflation supports global disinflation. This helps:

• Central banks worldwide

• Commodity price stability

• International trade flows

Impact on the Indian Nation

RBI’s decision affects India’s economy in multiple ways. Both short-term and long-term implications exist.

Economic Stability

Monetary Policy Credibility:

• Consistent policy framework

• Inflation targeting success

• Market confidence improvement

Financial System Health:

• Banking sector stability

• Credit growth sustainability

• Systemic risk management

Fiscal Policy Coordination

Government Support:

• GST rationalization helps

• Infrastructure spending continues

• Reform momentum maintained

Debt Management:

• Stable borrowing costs

• Fiscal deficit targets achievable

• Debt sustainability improved

External Sector Balance

Current Account Management:

• Export challenges from tariffs

• Import costs remain stable

• Service exports provide support

Capital Account Flows:

• FDI continues strongly

• Portfolio flows remain volatile

• Debt flows stay manageable

Impact on Common People

Regular Indians experience RBI’s decision in various ways. Daily life gets affected through multiple channels.

Borrowers Benefit from Stability

Home Loan Customers:

• EMI amounts stay predictable

• No rate shock during festive season

• Planning becomes easier

Personal Loan Holders:

• Interest rates remain stable

• No sudden payment increases

• Budget planning improves

Savers See Mixed Results

Fixed Deposit Holders:

• Rates likely to stay stable

• No immediate decline expected

• Returns remain reasonable

Senior Citizens:

• Pension fund stability

• Interest income predictability

• Inflation-adjusted real returns

Daily Expenses Impact

Food and Essential Items:

• GST cuts reduce prices

• Inflation remains low

• Purchasing power improves

Transportation Costs:

• Fuel prices stay manageable

• Public transport remains affordable

• Vehicle loan EMIs stable

Employment Opportunities

Job Market Conditions:

• GDP growth supports hiring

• Service sector expansion continues

• Manufacturing jobs grow

Wage Growth Prospects:

• Low inflation supports real wages

• Skill-based premium increases

• Rural employment improves

Future Predictions and Outlook

Looking ahead, several scenarios seem possible. Economic conditions will determine RBI’s future moves.

Next Policy Meeting Expectations

December 2025 Meeting:

• Rate cut probability increases

• 25 bps reduction likely

• Depends on global conditions

Key Factors to Watch:

• US-India trade negotiations

• Inflation trajectory

• Growth momentum sustainability

Short-Term Forecasts (3-6 Months)

Economic Indicators:

• Q2 GDP likely at 7%

• Inflation may touch 1.8%

• Exports face continued pressure

Policy Responses:

• More GST rationalization possible

• Export support packages likely

• Infrastructure spending acceleration

Medium-Term Outlook (1-2 Years)

Growth Trajectory:

• Sustainable 6.5-7% growth

• Manufacturing sector revival

• Service exports boom

Inflation Management:

• Target range maintenance

• Food price stability

• Core inflation control

Long-Term Vision (3-5 Years)

Economic Transformation:

• Viksit Bharat goals

• Digital economy expansion

• Green transition acceleration

Monetary Policy Framework:

• Flexible inflation targeting

• Financial stability focus

• International coordination

Key Takeaways for Investors

Today’s RBI decision offers important lessons. Smart investors should consider these insights.

Investment Strategy Implications

Debt Mutual Funds:

• Duration funds may gain

• Credit risk funds stable

• Liquid funds remain attractive

Equity Market Focus:

• Domestic consumption themes

• Infrastructure and construction

• Technology and services

Real Estate Opportunities:

• Residential demand stays strong

• Commercial real estate grows

• REITs offer stable returns

Risk Management

Currency Hedging:

• Export businesses need protection

• Import cost management crucial

• Natural hedges preferred

Interest Rate Exposure:

• Fixed rate borrowing advantageous

• Variable rate deposits flexible

• Duration matching important

Sector-Specific Impacts

Different industries will experience varying effects. Understanding these helps business planning.

Banking and Financial Services

Positive Factors:

• Net interest margins stable

• Asset quality improving

• Digital transformation continuing

Challenges:

• Competition for deposits

• Credit demand moderation

• Regulatory compliance costs

Real Estate and Construction

Growth Drivers:

• Festive season demand

• Government infrastructure push

• Affordable housing focus

Risk Factors:

• Input cost pressures

• Labor availability

• Regulatory changes

Information Technology

Opportunities:

• Global digitization trends

• AI and automation demand

• Cloud services growth

Concerns:

• US visa policy changes

• Client budget constraints

• Competition from local players

Conclusion

RBI’s October 2025 policy reflects careful balancing. The central bank prioritized stability over aggressive easing. Moreover, upgraded growth forecasts show confidence in India’s resilience.

Key highlights include:

• Repo rate steady at 5.5%

• GDP growth raised to 6.8%

• Inflation cut to 2.6%

• Neutral stance maintained

For common people, this means predictable borrowing costs and controlled inflation. Businesses get stability for planning while markets receive clear policy signals.

Looking ahead, RBI seems ready for future easing. However, global trade developments will influence timing. The central bank’s prudent approach builds credibility for challenging times ahead.

India’s economy shows remarkable resilience. Despite external headwinds, domestic fundamentals remain strong. This positions the country well for achieving its Viksit Bharat vision.

Disclaimer

This content consolidates information from multiple reliable sources for educational purposes. It doesn’t constitute financial, investment, or professional advice. Readers should consult qualified financial advisors before making investment decisions. The author and publisher disclaim liability for any financial decisions based on this content.

Sources

- https://timesofindia.indiatimes.com/business/india-business/rbi-mpc-meeting-october-2025-live-updates-rbi-governor-sanjay-malhotra-mpc-repo-rate-cut-monetary-policy-committee/liveblog/124246306.cms

- https://www.moneycontrol.com/news/business/economy/rbi-mpc-meeting-highlights-october-2025-governor-sanjay-malhotra-repo-rate-change-key-announcements-13592071.html

- https://www.moneycontrol.com/news/business/rbi-monetry-policy-meting-live-rbi-mpc-october-2025-repo-rate-announcements-governor-sanjay-malhotra-speech-liveblog-13591777.html

- https://www.business-standard.com/finance/news/rbi-mpc-meeting-live-updates-october-2025-monetary-policy-committee-meeting-governer-sanjay-malhotra-repo-rate-latest-news-125100100070_1.html

- https://www.moneycontrol.com/news/business/economy/rbi-mpc-on-october-1-will-rbi-wait-for-tariff-situation-to-resolve-before-acting-on-policy-13591346.html

- https://economictimes.com/news/economy/policy/why-rbi-did-not-cut-rate-governor-malhotra-explains/videoshow/124248343.cms

- https://economictimes.com/news/economy/indicators/rbi-gdp-growth-report-update-mpc-meeting-2025-1st-october-fy26-growth-forecast-revised-to-6-8/articleshow/124247528.cms

- https://www.news18.com/business/rbi-monetry-policy-meting-live-rbi-mpc-meet-october-2025-repo-rate-cut-announcement-today-sanjay-malhotra-speech-home-loan-interest-news-liveblog-ws-l-9607124.html

- https://economictimes.com/news/economy/policy/rbi-mpc-keeps-repo-rate-unchanged-at-5-5-says-governor-sanjay-malhotra/articleshow/124246905.cms

- https://www.cnbc.com/2025/10/01/india-rbi-holds-rates-steady-at-5-5percent-in-line-with-forecast-as-inflation-cools.html

- https://economictimes.com/news/newsblogs/rbi-monetary-policy-meeting-live-updates-rbi-repo-rate-fy-2025-26-1st-october-reserve-bank-of-india-governor-sanjay-malhotra-decision-gdp-cpi-mpc-highlights/liveblog/124245607.cms

- https://www.hindustantimes.com/business/rbi-monetary-policy-a-repo-rate-decision-is-going-to-be-a-juggling-act-for-governor-sanjay-malhotra-101759221328304.html

- https://www.cnbctv18.com/economy/rbi-monetary-policy-mpc-meeting-live-updates-repo-rate-interest-cut-sanjay-malhotra-announcements-gdp-inflation-liveblog-19698923.htm

- https://www.news18.com/business/economy/rbi-raises-fy26-gdp-growth-forecast-to-6-8-from-6-5-earlier-ws-l-9607466.html

- https://www.financialexpress.com/policy/economy-rbi-mpc-meeting-october-2025-live-updates-rbi-governor-sanjay-malhotra-big-announcements-on-repo-rate-loan-interest-rate-gdp-inflation-3994840/

- https://www.cfieducation.in/blogs/interest-rates/

- https://www.angelone.in/news/market-updates/rbi-mpc-october-2025-inflation-repo-rate-and-market-expectations-ahead-of-policy-decision

- https://www.thehindubusinessline.com/money-and-banking/rbi-monetary-policy-committee-mpc-meeting-october-1-2025-live-news-updates/article70114326.ece

- https://www.reuters.com/world/india/india-central-bank-keeps-repo-rate-steady-widely-expected-2025-10-01/

- https://currentaffairs.adda247.com/rbi-bi-monthly-monetary-policy-2025-repo-rate-gdp-growth-and-inflation-forecast/

Leave a Reply